Personal Loans

Customized financing to consolidate high-interest debt and unlock financial flexibility.

Business loans

Tailored commercial financing that supports all your business needs to help you grow quickly.

Tailored for entrepreneurs that want to establish additional active and passive income streams.

Customized financing to consolidate high-interest debt or fund major purchases or expenses.

About BHG

Programs

Sign in

Loans for Medical Professionals

Extraordinary loan solutions for medical professionals

-

Proprietary underwriting for medical professionals

-

No impact on your credit score to apply1

-

No personal collateral required

-

U.S.-based concierge service available around your schedule

- Personal Loans

- Business Loans

How much are you looking to finance?

No application fees, commitment, or impact on personal credit to view your estimate.

How much are you looking to finance?

No application fees, commitment, or impact on personal credit to view your estimate.

Healthcare is our heritage

23 yrs

experience lending to medical pros

$10B+

medical loans funded

80K+

medical pros funded

Ways to use your loan

What is a medical professional loan?

Elite professionals deserve comprehensive support and resources. With BHG Financial, healthcare professionals can use personal or commercial loans with exceptional amounts and customized repayment options to pave the path forward for their lives and careers.

Medical Professional Loans

We've curated loans for healthcare professionals since 2001

With large loan amounts and low payments, a loan from BHG Financial makes it easy for medical professionals, like you, to capitalize on personal and professional opportunities.

-

Veterinarians

-

Nurses

-

Physician assistants

-

Chiropractors

-

Pharmacists

-

Physical therapists

-

Radiologists

-

Psychologists

A HASSLE-FREE PROCESS

How our loans for medical professionals work

As a busy medical professional, your time is valuable. At BHG Financial, we’ve streamlined the application process to get you funded fast so that you can get back to business.

1. Start an application

Unlike other lenders, we won't ask for unnecessary paperwork. It’s easy and there’s no impact to your credit score to apply.1

2. Get your funding decision

Approval can take as little as 24 hours.6 Our dedicated loan specialists will review your application and qualifications, tailoring a loan solution for your financing needs.

3. Receive funds fast

If approved, you will receive your funds in one lump sum in as few as 3 days for business loans and 5 days for personal loans.6

Medical professional loans from industry experts

From our founding as Bankers Healthcare Group in 2001 to now, we remain committed to providing exceptional loan solutions to physicians, dentists, and veterinarians like you.

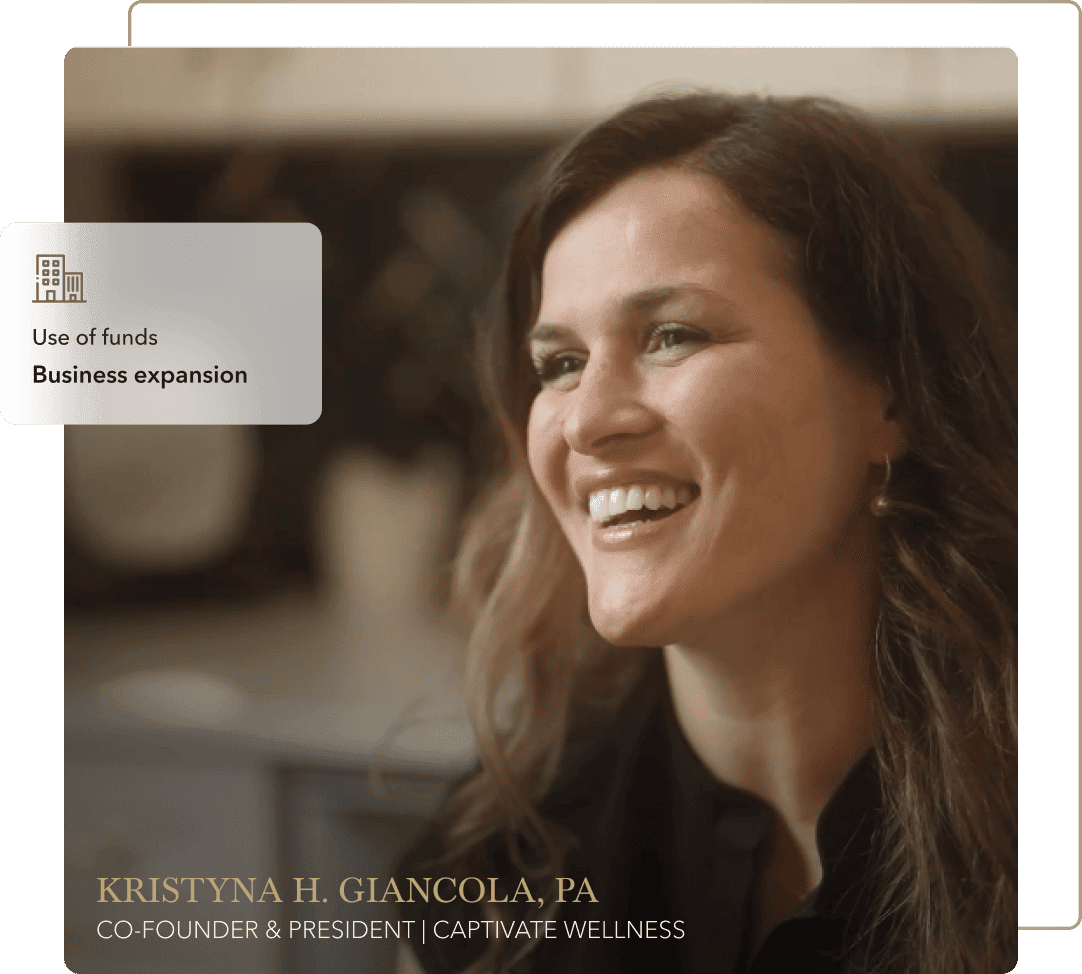

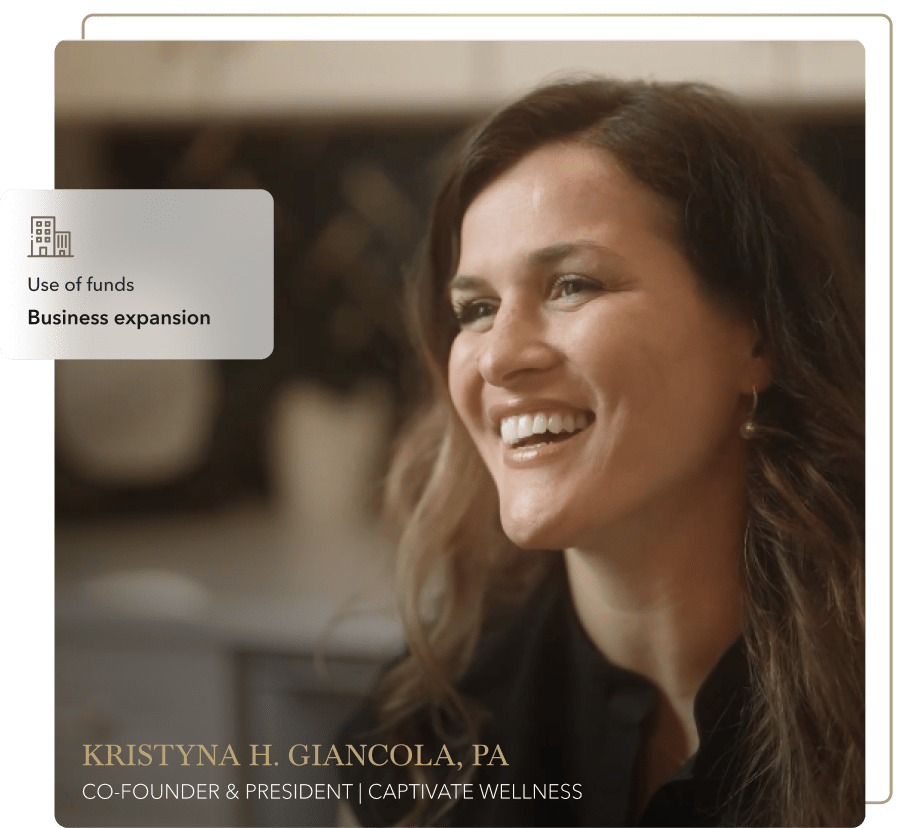

How our medical professional loans empower customers

BHG Financial is committed to the success of medical professionals.

LEARN MORE

Medical professional loan FAQs

There's no doubt that medical procedures can be expensive, so many lending partners will offer their customers personal loans, sometimes called medical loans, that can be used to pay off medical debt or operations.

Meanwhile, BHG Financial’s loans for healthcare professionals are extraordinary financial solutions designed specifically for exceptional doctors, dentists, and veterinarians. We offer personal and business financing for healthcare professionals, which can be used for personal debt consolidation, business debt consolidation, practice expansion, and new business opportunities, respectively.

Doctors and physicians are highly specialized and compensated careers that can help these elite professionals qualify for better loans than other professions. Whether these professionals need fixed-interest loans, high withdrawal sums or extended repayment terms—that may not be offered to those with a lower credit score—BHG Financial can provide financial support.

Applying for a medical professional loan with BHG Financial is as easy as 1-2-3.

- Filling out an online application quickly or call us directly to speak to a loan specialist.

- We'll gather the necessary documentation for you, which may include income verificiation documents such as tax returns and bank statements. If anything else is needed to process your application, we'll reach out to work with you.

- After we've received all the necessary information and documents, our team will review your qualifications and notify you promptly regarding approval.

BHG Financial considers applicants using their credit history and personal and business income, among other factors provided at the time of the loan application.

Not all solutions, loan amounts, rates or terms are available in all states.

1 There is no impact on your credit for applying. For personal loans, a complete credit history, which will appear as an inquiry on your credit report, will be performed upon acceptance and funding of the loan and may impact your credit.

2 Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile.

3 Personal Loan Repayment Example: A $59,755 personal loan with a 7-year term and an APR of 17.2% would require 84 monthly payments of $1,228.

Annual percentage rates (APRs) for BHG Financial personal loans range from 11.96% to 27.87%, with terms from 3 to 10 years.

4 BHG Financial business loans typically range from $20,000 to $250,000; however, well-qualified borrowers may be eligible for business loans up to $500,000.

5 Business Loan Repayment Example: A $94,695 commercial loan with a 9-year term and an APR of 14.8% would require monthly payments of $1,591.

Annual percentage rates (APRs) for BHG Financial business loans range from 8.69% to 41.26%, with terms from 1 to 12 years.

6 This is not a guaranteed offer of credit and is subject to credit approval.

Consumer loans funded by Pinnacle Bank, a Tennessee bank, or County Bank. Equal Housing Lenders.

Testimonial(s) based on unique customer experience. Individual customer experiences may vary.

For California Residents: BHG Financial loans made or arranged pursuant to a California Financing Law license - Number 603G493.

IMPORTANT INFORMATION ABOUT ESTABLISHING A NEW CUSTOMER RELATIONSHIP

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies every customer. What this means for you: When you apply for a loan, we will ask for your name, address, date of birth, social security number and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents. If all required documentation is not provided, we may be unable to establish a customer relationship with you.